As an employee, you must submit an investment declaration proofs before the end of the year (or by January latest). Now, what is an investment declaration? It is a document in which you provide your investment proposition and then will provide proofs for at year end. In this blog, I will be talking about all you need to know about investment declaration and how the taxes will be calculated and deducted in your payroll.

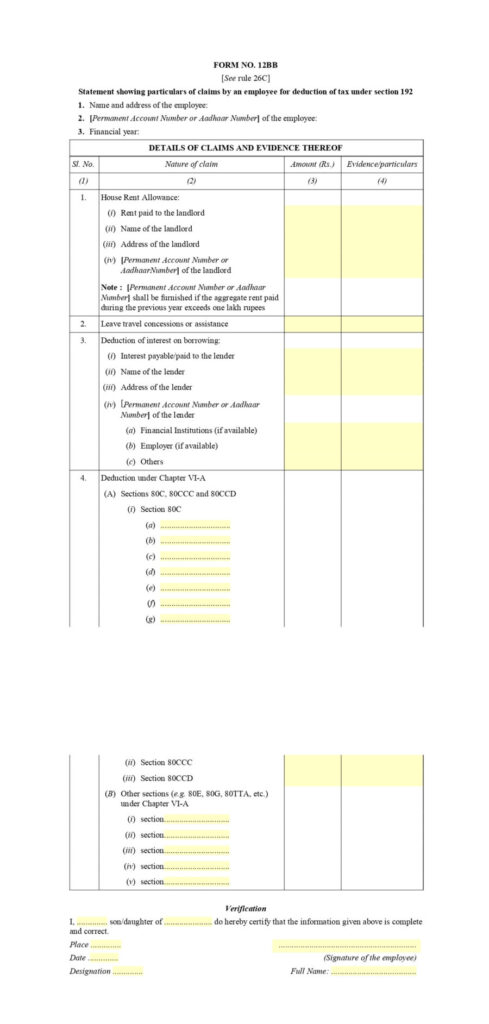

In the first part of Form 12BB, you can fill the details required to claim tax deduction on HRA.

To claim HRA, you need to provide details such as:

To claim tax deduction on interest paid for home loan, you also need to provide details like interest paid /payable, lender’s name, lender’s PAN in Form 12BB.

Stamp duty, registration fees and brokerage expenses paid towards transfer of the property can be claimed as deduction.

Here is a quick list of deductions available under Section 80 that you can declare in Form 12BB.

The Form 12BB is also an assertion of cases by a representative for allowance. With impact also from first June 2016, a salaried employee is needed to present the Form 12BB to their employer to guarantee tax reductions or refund on ventures and costs. Form 12BB must also be submitted toward the end of the financial year.

Form 12BB applies to all salaried citizens. Using Form 12BB, an employee needs to announce the ventures that they have made during the year. Narrative proof of these speculations and costs must also be given toward the end of the financial year.

Employers provide a cut-off date for submission of investment or expense proof. Usually, this date lies in January or February, so that shortfall of taxes is recovered in the remaining months of the financial year.

Here’s the table for verification tips for employers for the most popular tax-saving investments:

For most employees, HRA is also a part of their salary structure and provides benefits for the rental expenses made during the year.

The benefit amount available to employees is the least of the following:

The rent receipts can be monthly/ annually.

If the rent paid is higher than Rs 1 lakh in a year, owner’s PAN is mandatory.

Also transfer record showing the amount along with the date of investment.

Any amount paid, other than also for preventive health check-up, should be in electronic form.

Medical bills for senior citizen parents can be claimed if there is no active insurance plan for them.

In most companies, the collection of investment proofs is a manual and menial process. In your company if you do this manually, you need to store the physical copies of the proofs across 100s of employees. Later if and when your auditor asks for a proof, you might need to retrieve these documents and provide the same. A good payroll software such as Asanify simplifies this whole process by empowering employees self-submit the proofs online. Additionally, there is a built in workflow approval engine that enables managers to approve or reject the proof values. Moreover, this is all in a beautiful easy to use and delightful interface.

Don’t you think that work needs to feel wonderful? If an employee has to spend hours submitting tax declarations, that’s valuable time wasted. Moreover, this time could have been used productively to build your business. A smart payroll software automates this whole process. Asanify even gamifies the experience for employees and lets them save taxes.

Investment proof is the actual proof employees must submit to claim income tax deductions. There fixed rules laid down by the Department of Income Tax, India. These rules define how much income tax deduction the employee can get.

All employers are needed to save this proof for the following 6 years. Storing these items manually or even digitally across emails or whatsapp may cause a lot of problem. As a small business leader, please consider keeping all such documents in a central location. Otherwise you may store all such information in a payroll software.

As a payroll admin, you need to deduct taxes from your employees’ payroll monthly. These taxes depend on the deductions as per employee declarations.

The Investment Proof Verification System operates as follows:

Submit the ELSS fund statement and premium paid receipts respectively.

As an employee you stand to lose a lot of taxes if the declarations are not given on time. Additionally many companies mandate a cut off time for actual proof submissions. Further, if the proofs do not tally then the entire deductions are ignored and employee bears a large amount of tax.

If you have not declared your investments before and your employer has deducted excess TDS, then you can claim refund of excess TDS deducted by filing your income tax return.

Investment proof submissions are time consuming and manual. To prevent prolonging the process, avoid the common mistakes listed below.

As an employee, you need to plan the annual investments at the beginning of the year. You may consult your personal accountants for advice. Asanify payroll is unique in the sense that it provides a gamified interface to evaluate the exact tax saving possible under each tax head.

The Employee must keep the copies of investment proof if they work in a manual payroll system. In case of audit from Income tax office – these will be required. Otherwise for automated payroll software, the proofs may be digitally stored.

Employees must follow the organization rules to submit expense reimbursement requests. In the event that the employee neglects to do as such, at that point a similar compensation part will be taxable and the organization will tax it.

The last date of Income Tax Investment Proof accommodation with the employer is typically January 15. This is because the tax implication may be such that the Jan, Feb and March salaries may need to be sufficiently reduced. This happens when the employee cannot provide appropriate proofs of the investments. Thus the amount you previously deducted for tax – for April to December may now need to be clawed back across the 3 remaining months.

Additionally, there is a chance that the employee needs to make more investments at later date. As an admin, you should ideally create a clear communication so that employees can submit proofs well on time. For this situation, the employee also needs to inform the employer about all such future investments. In light of employee assertion, the employer considers them for tax allowance purposes. Hence, an employee ought to present a presentation so they can be considered by their employer. Otherwise, they will also miss the tax advantage.

A little error in the submission of Income Tax Proof may also cause significant delay. The employee should pay attention to this cycle. Typically small business admins take 30 days time to finish verification of all these proofs. In Asanify’s experience, up to 80% of employees submit proofs on the last day. It’s important that employees also give the finance group adequate chance to check proofs. On account of any mistakes, they will at that point have sufficient chance to caution the employee and redress it.

Additionally note that verifying all the investment proofs across 100s of employees is a time consuming process. A full service payroll provider such as Asanify does this automatically. This frees up your finance and leadership to grow your business instead of doing these manual work. Asanify uses a mixture of AI to automatically read expense images and manual checks to do this in a foolproof way.

Toward the end of the tax year, employees will be given a Form 16. It is given to the employee in the period of May or June each year.

The employee can get all the Income details they received from their employer in the last financial year alongside TDS credited to their account throughout the year.

In the event that the employee had various employers in the financial year; the employee will get a different Form 16 from every employer for the period which they worked for every employer. Form 16s are key records for employees to document their yearly Income Tax documenting, which should be submitted before July 31st (typically) every year.

At the point when a Form 16 is being given, a ‘Digital Signature Certificate’ (DSC) of approved signatory for each Form 16 is also required. A Digital Signature Certificate is also a protected advanced key; that is given by the affirming specialists also to approve and checking. Digital Signatures also utilize the public key encryptions for added security

Investment declaration is a great way for employees to save significant taxes. Additionally, for startups and small businesses this may require a lot of supervision and additional effort. Using an automated payroll software can save 100s of hours of manual work.

To break things down, the new tax regime is just a more simplified version of the older one. The core fact is that it offers a lower tax rate while removing exemptions from the older scheme at the same time. All one needs to do is submit Form 12BB declarations to their employers. It is important to note that employees can claim rebates under Section 87A till Rs 25,000 and the standard deduction of Rs 50,000.

As mentioned above, the new tax regime, introduced in 2020, is all about simplifying the older system. Employees opting for this new regime can’t claim exemptions in Form 12BB. However, it is important that they submit it. Apart from the deductions that can be claimed (as mentioned above), one of the core differences between the two regimes is this. Under the old regime, tax-free income stands at Rs 5.5 lakh. On the other hand, it is 7.5 lakh under the new tax regime. So yes, Form 12BB is very much crucial and submitting it is mandatory for employees.

You can claim tax benefit on the interest paid on home loan and also on principal repaid.

How do I declare an investment proof?To declare investment proof, submit a copy of your FD receipt or print out your FD receipt/statement from your bank website.

What is investment declaration form for pensioners?An investment declaration form is a provisional statement that has details about your proposed investments and expenses that are income-tax deductible.

At the end of the financial year, you need to provide supporting investment proofs for these investments that you have specified in the declaration form.

In order to get tax deduction, the investment proofs you require to submit include your document of :

1. Insurance premium.

2. Investments made in tax-saving mutual funds.

3. Health insurance premium receipt.

4. Receipt of donation.

Yes, you can claim income tax exemption on both house rent allowance (HRA) and repayment of home loan.

If you are living in a house on rent and servicing home loan on another property – even if both the properties are located in the same city – you can claim tax benefit for both.

Not to be considered as tax, legal, financial or HR advice. Regulations change over time so please consult a lawyer, accountant or Labour Law expert for specific guidance.

September 8, 2020

December 1, 2021